Market Recovery

Here are the Fundamentals

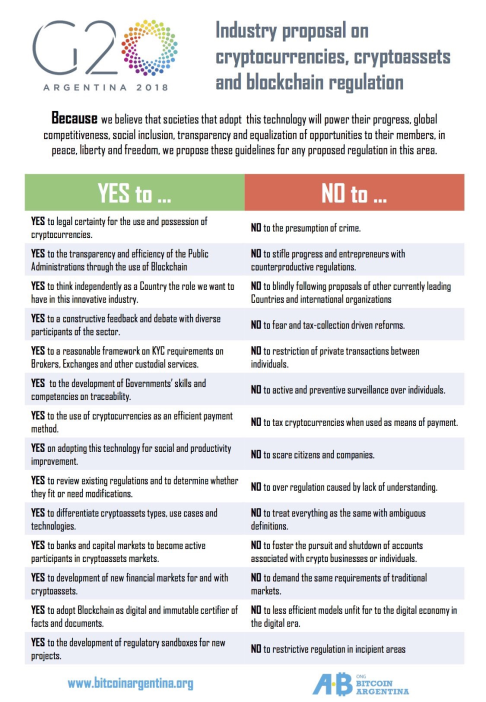

1.1 The Crypto Market Pulse is showing signs of recovery, similar to a pulse recovery on an EKG machine. Bitcoin and the Alts are once again showing signs of life! This comes following the long anticipated catalyst, G20 summit brief was issued some 48hours ago, and was followed by a 16% bitcoin price rally. Very similar to the early morning before the SEC and CFTC hearings early February, when touched bottom at 6k then 5800 at 2am CST, 9 hours prior to the hearing. Attached is the G20 Proposal:

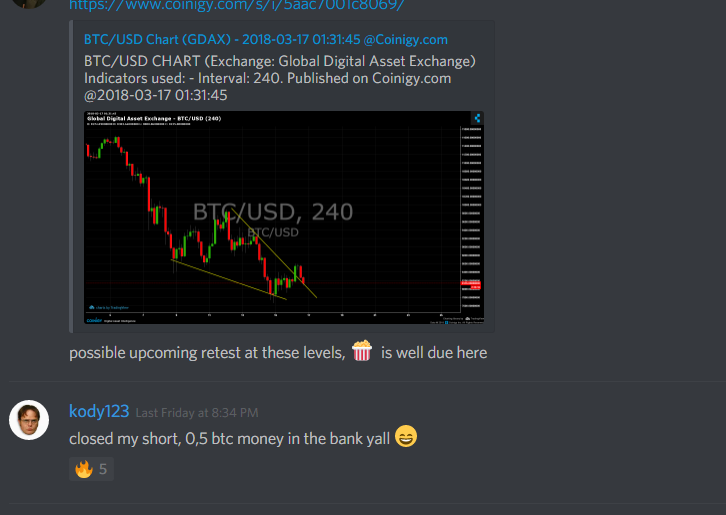

Fundamental Trading Tip: Short selling BTC through a FUD era leading up to regulatory meeting has proven to be a successful and profitable trade. Short side trade must be closed at the re-test of the falling wedge (see section 3).

A Technical Look Into BTC

2.1 Have we broken the bearish sentiment? Almost, we’ll start assessing our technical view with the most basic downtrend resistance line. Some might argue the validity of this line as we’re assessing it on a linear, non-log chart. They key factor here, is that we’re seeing plenty of friction with this downtrend resistance trend line, which makes it more and more valid. 7 Pivot points along the main trend line can NOT be refuted.

As BTC experiences her fourth crossing of the current downtrend, with a moving average crossover on the 6 hour chart, this signifies the first bullish signal on BTC since the pullback from the double top at $11,600.

Further Asessmet:

2.2 Last week our lead analyst highlighted a “failure swing” on RSI, and indicated that we are experiencing an early sign of an upcoming reversal. He then refrained from shorting selling, and started looking for possible accumulation entries for a long. Now, and as of today, RSI has only proven him right, what started as a failure swing, has turned into a bullish RSI divergence. Suggesting further upside in the upcoming days.

Trading strictly on RSI is non-conclusive so we added the Directional Movement Index, represented by 3 lines.

ADX, Average Directional Index, in cyan. ADX being at a non-peak and possible trough. Suggests that BTC is in an uncertainty zone for the current time being. Highlighted in purple are 2 possible ADX turning scenarios.

DI+ currently above DI-, suggesting another bullish signal. Well what are we waiting for?

A definitive trough “bottom” on ADX, or a head turn, along with a higher high on DI+ (Green Line) and more positive price movement.

The Key finding here, is that we’re seeing more bullish than bearish signals with the market’s current state.

Navigating the Chop with GC:

3.1 At Generation Crypto, we’ve been preparing our community for the choppy market conditions and trading accordingly. From consolidating into BTC, to USD, and margin Trading BTC on leverage. We’ve experienced good hedging, solid gains, and minimal losses during this era.

More engaged community members have strived to make the most out of every market opportunity by utilizing material from our workshops.

Recent Workshops include:

Short-Long Trading BTC on Leverage. 2/27

Directional Movement Index. 3/15

Chart Formations. (Flags, Pennants, Wedges, HnS, Wedges, Diamonds) 3/16

Fibonacci Pitchfans. 3/11

Community Profits:

4.1 At Generation Crypto, we take pride in our community profits, as a constantly rising equity curve is the only reason to be a market participant. Here are some screen recent screen shots of our chatroom.

Several of these gains where based on community member decision making, based on workshop material.

Are you ready to make the most out of your Crypto experience? Stop getting REKT, and unproductive HODLs!

To join the Profit Rocket Squad, click the link below and schedule a private tour with a community expert!

Gain access to our PowerScans, Powerhours, and community trades in our 24/7 Chatrooms. Schedule a one on one appointment with our resident analyst to show you around the VIP area.