Altcoin Season is here, followed by an

Incoming Historical Green Quarter!

1.1 Shift in Market Dynamics:

The Crypto Market is experiencing a shift in dynamics and demonstrating a dominance correlation that we’ve never witnessed in the past.

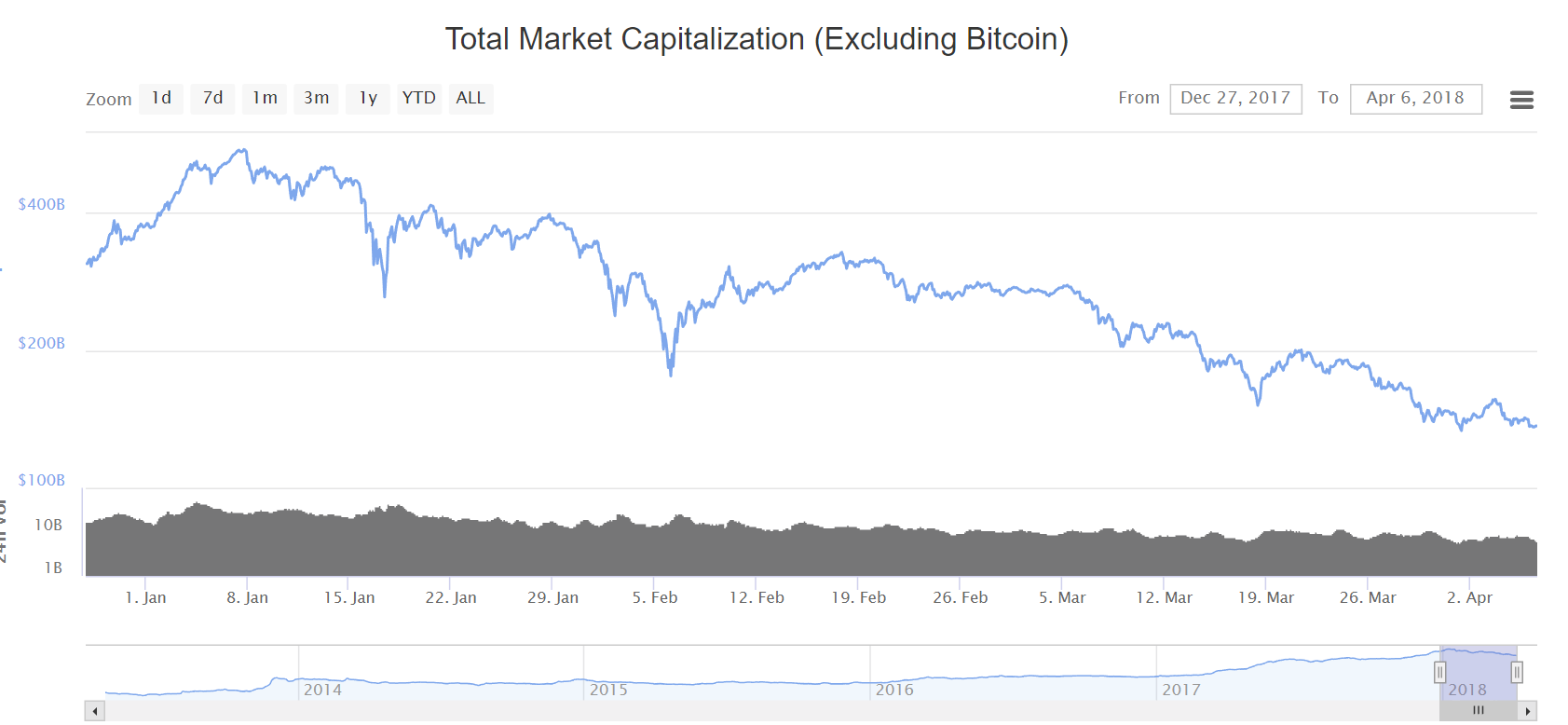

Altcoins are in a rally while BTC and the Altcoin market caps are in decline. Since almost every token is paired to BTC, and BTC has been in a decline, we’re not going to experience a gain in either market cap. But an analysis of current market dominance clearly demonstrates that alts are in a rally. This leads me to conclude that BTC holdings are being traded for altcoins.

In this report I will highlight the nature of this rally and why we’re experiencing.

Although this rally isn’t as prominent as the one we experienced in late 2017 and going into early 2018,

and not all Altcoins are making upwards strides, only a select few, while others are just holding their current BTC value, and the majority are retracing to their previous lows.

Dominance Analysis

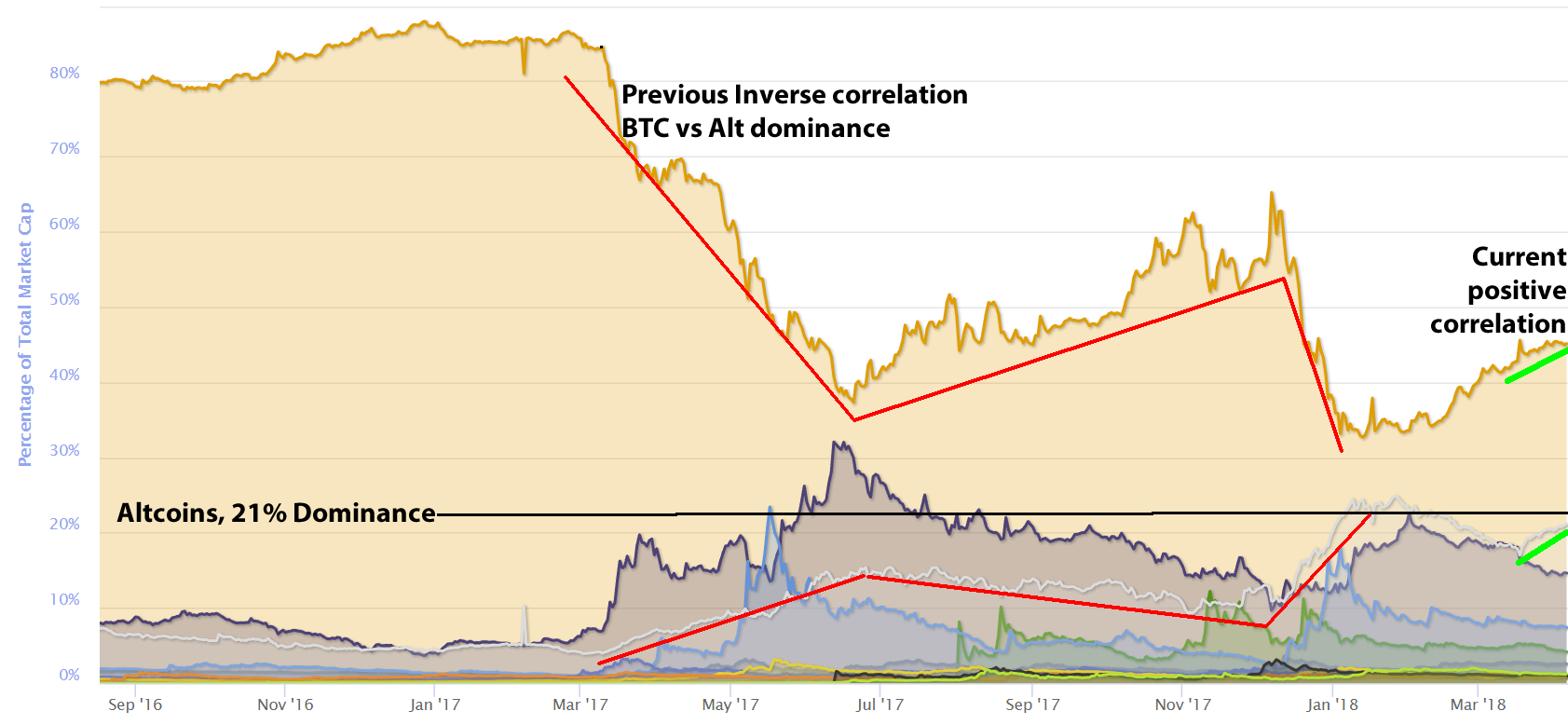

2.1 Altcoin BTC Dominance Correlation: IAltcoin dominance is charted in white, this metric is for “other” alts, and excludes some of the prominent alts, (XRP, LTC, NEO, ETH, DASH). Before we dive into the nature of this rally I’d like to highlight the current positive correlation between BTC Dominance and Altcoin Dominance, the tiny green line on the right of the chart. Historically BTC and Alts have had inverse correlations, this is demonstrated by the red lines on the chart.

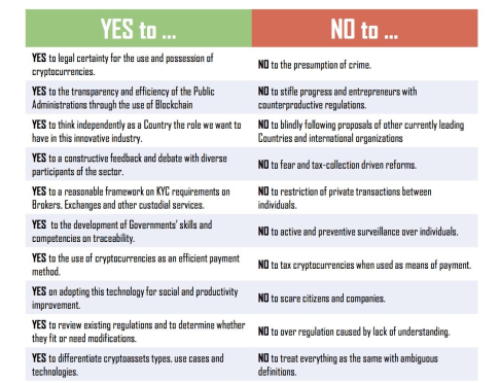

A speculative assumption for this shift, would be the incoming pairing of Alts to USD, we’ve seen this happen on several exchanges and we can safely assume that this trend will continue. As most projects would love to segregate themselves from the volatility of Bitcoin, and get a fair market valuation without violent quarterly swings.

Though the current Altcoin market cap is at a low for the year, so current USD pairs aren’t yet contributing to this rise in altcoin dominance.

Contributing Factors:

2.2 Speculative Nature, and Fundamentals: This shift in dynamics can be explained by these factors, the incoming USD pairings, institutional custodial holdings contributing the upheld BTC value during the bear market, and tokens currently experiencing uptrends have a high probability of being listed on new fiat gateways, along with unannounced catalysts.

Historical Green Quarter:

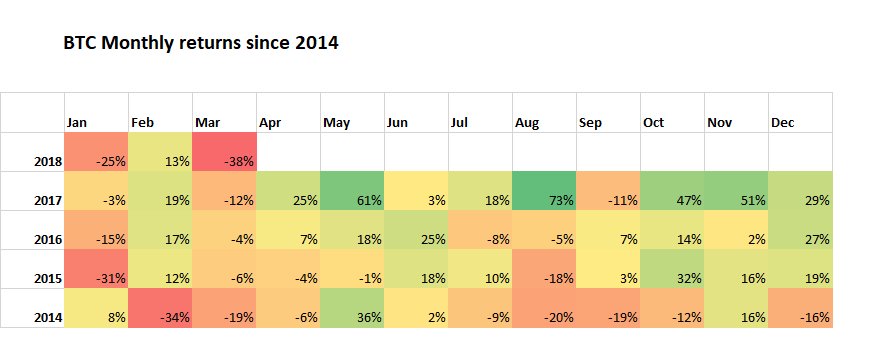

3.1 Q2 Positive Monthly Returns: Historically the last 4 years, the second quarter consisting of April, May, and June has been profitable for Bitcoin. So with an incoming BTC rally; picking the proper alts through technical screening and taking up positions in these alts is wise, and can be very profitable, especially with the current positive market dominance correlation.

Trading Altcoins with Generation Crypto:

If you traded with us last Altcoin Season you should be accustomed to astronomical gains. Our %2400 increase in BTC values during 2017 was life changing for many.

If you are interested in the Altcoins we’re currently taking positions on, Join our discord before the Market leaves you behind once again.